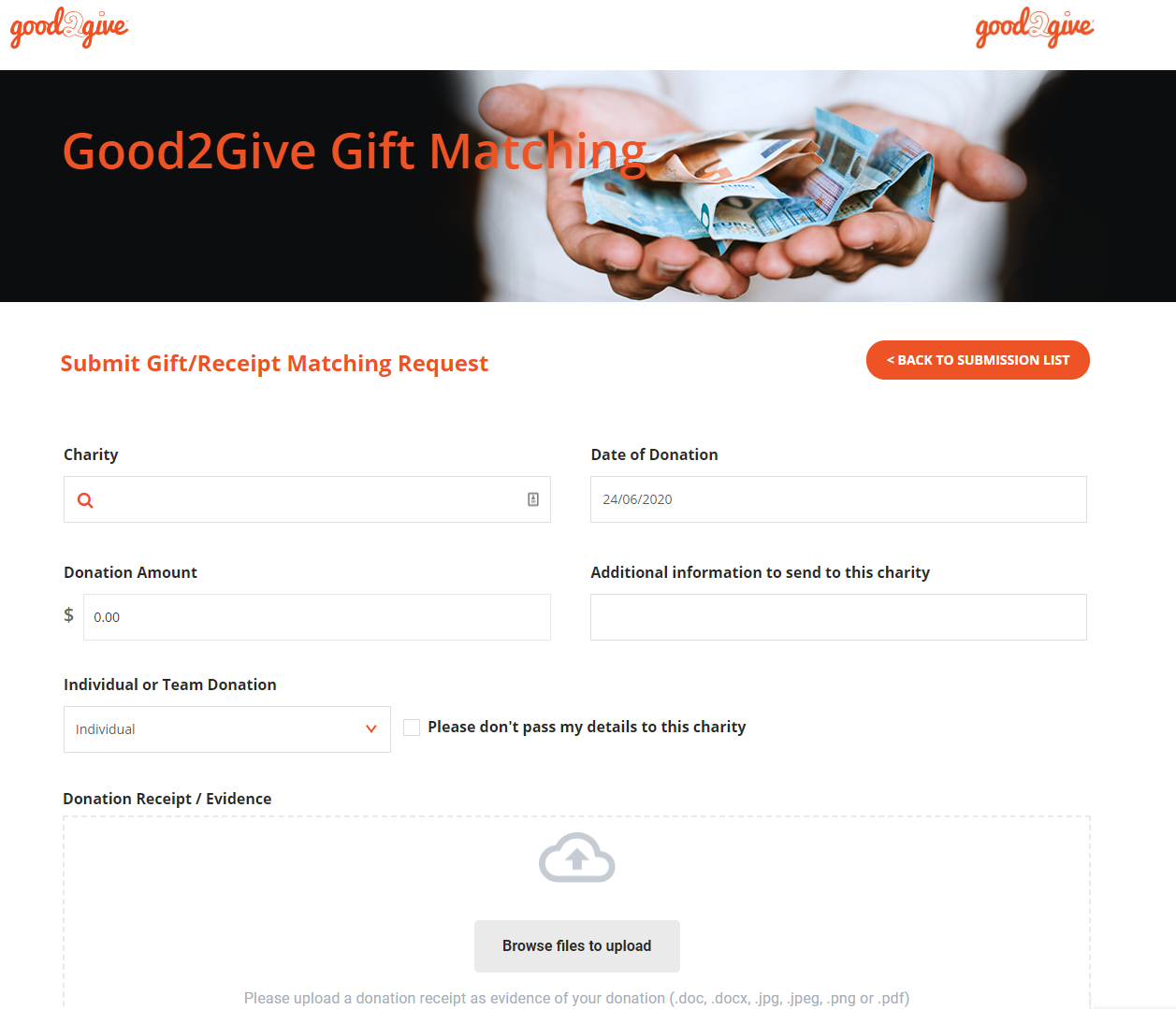

Post Tax Matching Request Form

To request for your post tax donation to be matched, go to the Gift Matching Tab at the top of your screen and complete the following fields:

Charity

Select the charity you have donated to by entering the first three letters into the charity search box and then selecting your chosen charity. Only charities which are registered on the Workplace Giving Platform are eligible for Post Tax matching. If your chosen charity is not available, you can request a new charity to be added to the platform by clicking on the “add a new charity” link.

Date of Donation

Provide the date the donation was made as it appears on the donation evidence receipt. You can select the date using the calendar picker which appears by clicking on the textbox or otherwise enter the date in the format dd/mm/yyyy.

Donation Amount

Enter the amount of the donation as it appears on the donation evidence receipt.

Additional information to send to this charity (optional)

If you would like to provide any additional information to your charity, you can enter this here. A maximum of 100 characters can be provided.

Individual or Team Donation

Please indicate whether the donation relates to an Individual or Team activity. If the donation you are apply to be matched is a personal donation select “Individual”.

Please don’t pass my details to this charity

Select this option if you want to remain anonymous to the charity and your contact details will not be provided to the charity.

Donation Receipt / Evidence

Upload a donation evidence receipt file which confirms the charity, date and amount of the donation. This could be a scanned image, photo or electronic copy of the receipt.

Please note the Workplace Giving Platform accepts the following file formats: .doc, .docx, .jpg, .jpeg, .png or .pdf.