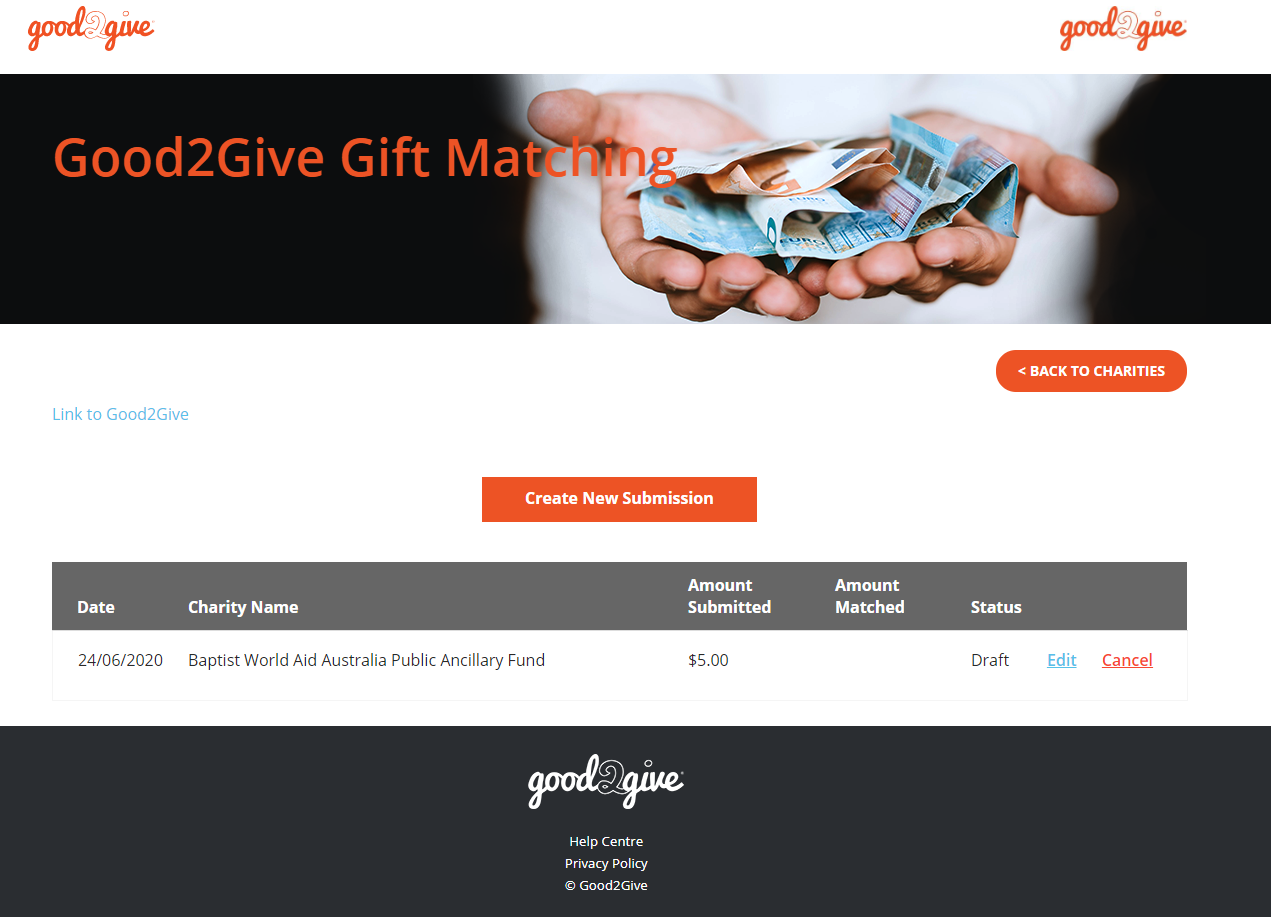

Matching Tab

The matching tab allows you to:

- Create a new submission request by clicking the Create Submission button.

- Review a history of all your matching submissions. Each submission record contains the following details:

| Field | Description |

|---|---|

| Date | The date the application was submitted. |

|

Charity Name |

The recipient charity receiving the donations. |

|

Amount Submitted |

The offline donation amount that has been requested to be matched. |

|

Amount Matched |

If the submission has been approved, the amount that has been matched by the platform subject to your organisation’s matching cap. |

|

Status |

Approved: The submission has been approved for payment to the charity. Pending: The submission has been referred to your CSR Manager for approval. You will be notified by email once the application has been reviewed. Draft: The submission has not been submitted. You can still edit or cancel the submission. Rejected: The submission has been declined by your CSR Manager. An email has been sent to you notifying you of the reason for the outcome. |

|

Actions |

The following actions are available or Pending and Draft submissions: Edit: Select this option if you want to change the details of the submission. Click the submit button when you are ready to submit the application. Cancel: Select this option to cancel the application. The application will be removed. |